Citigroup analysts are calling the effect of falling oil prices on global financial markets “oilmegaddon.” We think the term works well to describe looming cash flow, dividend, and credit problems at major oil companies too.

Citigroup analysts are calling the effect of falling oil prices on global financial markets “oilmegaddon.” We think the term works well to describe looming cash flow, dividend, and credit problems at major oil companies too.

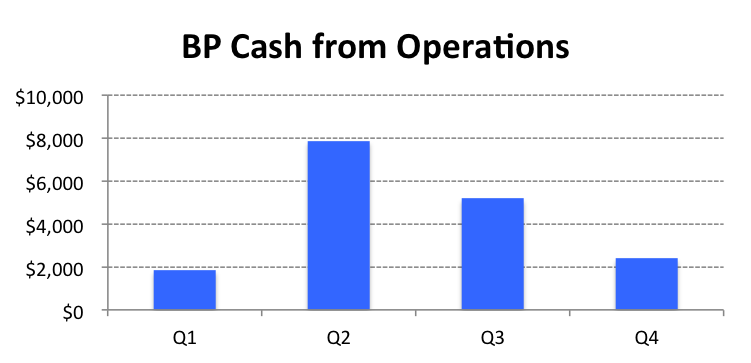

After peaking at $60.07 in June of 2015, the price of West Texas Intermediate Crude fell to $42.65 a barrel at year end. The effect on oil company cash flows was drastic, as BP’s experience shows. Adjusted for a $4.8 billion gusher of cash from declining receivables and inventories in the fourth quarter, the BP’s cash flow from operating activities was down deeply in the second half of the year.

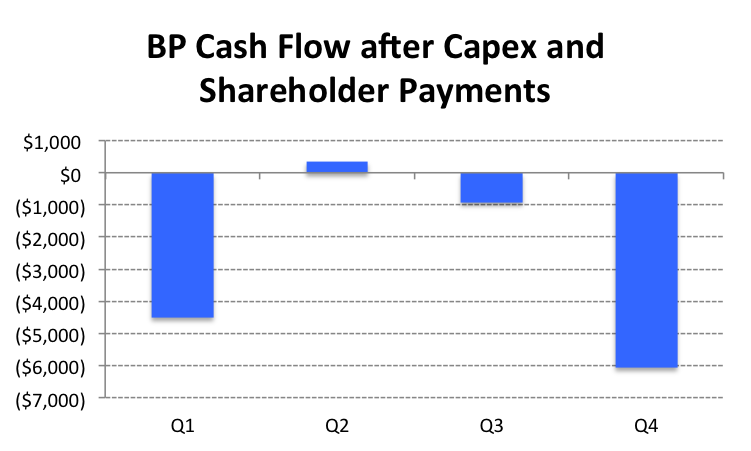

That did not stop the company from pumping money to its shareholders. Combined dividends and share repurchases in 2015 were $8.0 billion, and they actually increased as the year went on. Add heavy capital spending on exploration and production, and the deficit in cash flow after capital spending and shareholder payments was $11.1 billion for the year.

BP plugged the cash flow leak by cutting working capital, selling assets, and tapping cash reserves. But the credit concern is that those are not sustainable sources of funding. If, as seems likely, oil prices stay low, BP will have to trim dividends and share buybacks or boost borrowings.

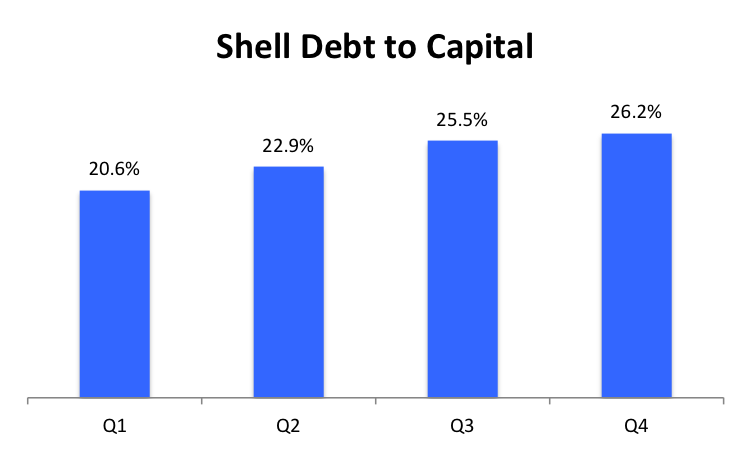

Raising leverage in the face of falling business fundamentals is risky. Shell did it in 2015, and was rewarded with a rating downgrade from Standard & Poor’s.

BP is starting 2016 with higher leverage (35.1% debt to capital) than Shell (26.2%), so it has less room for maneuver to avoid a downgrade. Not that BP is worried about a downgrade. Their CEO sees no problem with taking on more debt to maintain the dividend in 2016 .

This is a good instance of a broad pattern of behavior — management’s bias in favor of share holders over debt holders. It makes sense, when you consider who hires, fires, and pays the CEO. But it makes less sense, when you see that adding financial risk to compensate shareholders for rising business risks compounds total risk and hurts everyone in the long run.