Tesco just agreed to sell its South Korean operations for £4 billion, taking a loss of about £150 million on the sale. The deal will reduce borrowings by £4.2 billion over the next 18 months. That’s a step in the right direction, but it’s not enough.

Tesco just agreed to sell its South Korean operations for £4 billion, taking a loss of about £150 million on the sale. The deal will reduce borrowings by £4.2 billion over the next 18 months. That’s a step in the right direction, but it’s not enough.

Tesco may also sell its operations in eastern European and in Thailand to cut debt even more. Analysts think they could be worth as much as £5.9 billion. But even that would not be enough.

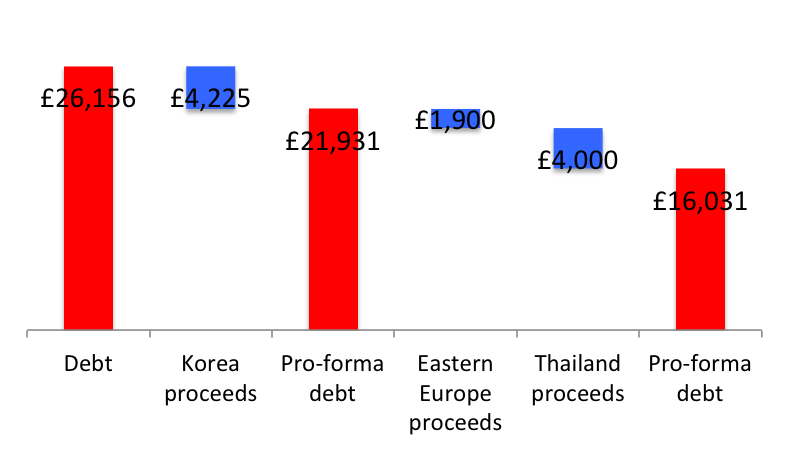

At the end of its latest fiscal year in February 2015, Tesco had £26.2 billion in adjusted debt, £4.2 billion in adjusted twelve-month EBITDAR, and shareholders’ equity of £7.1 billion. Adjusted debt to EBITDAR1 was 6.3x, and adjusted debt to capital was 79%. Proceeds from Korea would reduce those figures to 5.2x and 76%, while proceeds from Europe and Thailand would cut them to 3.8x and 70%.

As we said in an earlier post, because of the company’s high business risk we think it should be targeting debt to EBITDAR leverage of 3.0x and debt to capital of 40%. That means cutting debt by at least another £3.5 billion2 or raising EBITDAR to £5.3 billion and shareholder’s equity to £24.0 billion.

We just don’t see an easy way for Tesco to get there. Cutting debt through asset sales is promising, but it has problems. If the company keeps taking losses when it sells assets, that will cut into shareholders’ equity, which already is at dangerously low levels.

Asset sales take time. The Korea deal will span more than a year from deciding to sell to receiving payment and another year and a half from receiving the payment to trimming debt down to target levels3. With competitors growing stronger fast, Tesco may not have enough time for a gradual approach to reducing leverage.

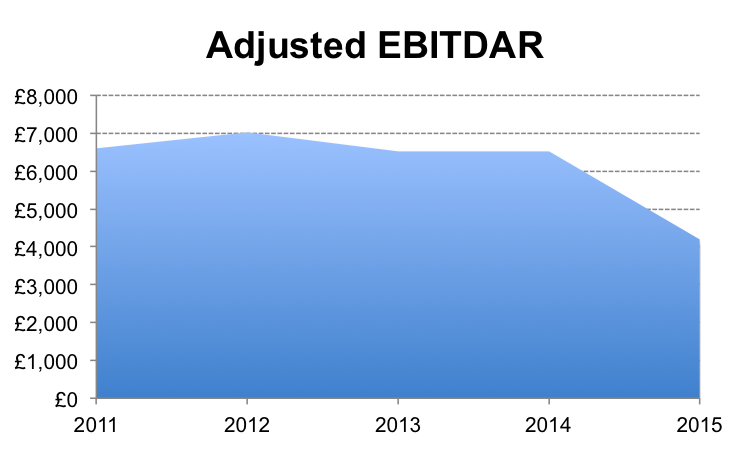

Increasing earnings is another way out of the leverage morass for Tesco. But adjusted EBITDAR has been falling for a long time under pressure from low-cost competitors, and the pressure is increasing4. There is low hope for adjusted EBITDAR reaching the minimum of £5.3 billion needed to bring leverage to the level we want2 any time soon.

Our debt-to-capital goal for Tesco seems even farther out of reach. There is no way for Tesco to do this without improbable improvements in earnings or gains on asset sales. By our estimates, it would take a £17.1 billion boost to shareholders’ equity to bring debt to capital to a safe level5, an amount that is way beyond any plausible rights offering Tesco could do.

Selling the Korean operations and reducing debt are important steps for Tesco, but they’re not enough. They don’t make Tesco’s financial condition good, just less bad. The company has a long way to go to get its financial risks in line with its business risks.

1 Debt adjusted for operating leases and pension liabilities and EBITDAR adjusted for special charges 2 Assuming £5.9 billion in debt reduction from selling Eastern Europe and Thailand 3 Tesco plans to repay debt only as it matures to avoid prepayment penalties 4 As we will explain in our next post 5 Assuming £5.9 billion in debt reduction from selling Eastern Europe and Thailand and shareholders’ equity of £6.9 billion (2015 shareholders’ equity less £150 million loss on the sale of the Korean operations)