Credit risk at Tesco

Credit risk at Tesco

Tesco disclosed details of its turnaround plan on January 8. The company was clear about its business problem — loss of share and profitability in the UK. And it was specific about the steps it is taking to tackle that problem — price cuts, store closings, and overhead cuts.

Tesco was less clear about its financial problem — too much leverage. It promised to “protect and strengthen the balance sheet” through capital spending and dividend cuts, possible asset sales, and pension spin-offs. But there was little sign of concern about the dangerous combination of risks we talked about in our last post, “Tesco’s in the Wrong Box,” nor was there a commitment to a better credit rating.

Fully adjusted for off-balance-sheet debt equivalents like pension obligations and operating leases, Tesco’s leverage for its half-year ending in August 2014 was 5.0x debt to EBITDA and 50.8% debt to capital. That is too high. Given the company’s high business risk, we think it should be targeting debt to EBITDA leverage of 3.0x and debt to capital of 40%, putting it at the lower end of range of its peer group for those measures.

Tesco can do that by improving earnings or reducing debt or both. We’re skeptical about a big or quick jump in earnings at Tesco. The challenge to its business model may be more than price and overhead cuts can overcome, there may be strong cultural resistance to change, and competitors are likely to respond with their own cuts.

Cutting credit risk at Tesco

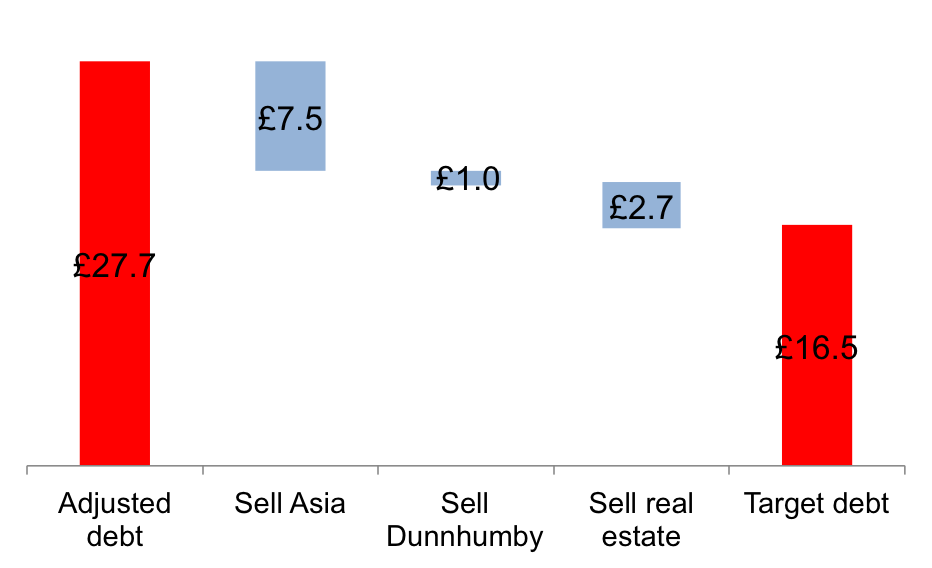

That leaves paying down debt as Tesco’s most attractive option for reducing financial risk. At the end of August 2014 Tesco had £27.7 billion in adjusted debt and £5.5 billion in adjusted twelve-month EBITDA. Assuming no improvement in EBITDA, the company needs to reduce debt to £16.5 billion to achieve our goal for leverage.

How will it get there? Planned savings on capital spending and the dividend could generate about £400 million a year. By one analysts estimates, Tesco could raise lots of cash from asset sales — its Asian operations could be worth £7.5 – 9 billion and its Dunnhumby loyalty card service £1 – 2 billion. Other analysts think its sellable real estate could we be worth £9 billion.

Of course Tesco needs to solve its basic business problem — an uncompetitive business model. But that is going to be hard to do and take a lot of time, if it succeeds at all. In the meantime it needs to lower its overall risk and deal with problems it has more control over — too much debt. Asset sales are a quicker and easier solution.

Tim….in your earlier post on Tesco you gave brief mention to the ‘financial reporting system’ and in this post none at all. Tesco was both a severe material profits restatement and IMHOP a warning sign about management. Sarah Dean at Citi wrote a report that is a great case study on the topic. ‘Learning the lessons from Tesco: Food for thought’ – 14pp 6 feb

https://www.citivelocity.com/rendition/eppublic/documentService/dXNlcl9pZD1kbWI4MnFZd0ZacyZhbD1maVlFWHJYVnUlMkZaZ2J2RlM4OU5JTEJaZTdwN1lwNEdPaENGWDgzT2ZoS3MlM0Q/ZG9jX2lkPTU1MTk2MiZwdWJJZD0xOTc2MTExJmFzc2V0Q2xhc3M9QUNDVkFMLEVRVUlUWSZjaGFubmVsPURDTSZzdWItY2hhbm5lbD1FbWFpbA#/

Thanks for the link, Kurt. I agree, the financial reporting problem at Tesco is a big one. I think it least about the impact on income, less about management (now that a new team is in place), and most about what I suspect is a culture that is struggling to adapt. I think there’s a lot more to say about Tesco, but I’m waiting to see the results of the government investigation and for more time to see if company’s leadership appreciates the extent of the changes needed to deal with the discounters and improve financial condition. Until they do, I think you’ll agree there will be plenty of credit risk at Tesco and some real debt structuring challenges.